The formula to compute NOI starts with calculating a property’s effective gross income (EGI) and subtracting the direct operating expenses, such as maintenance costs, repair fees, property management costs, utilities, and property taxes. Net Operating Income (NOI) → The NOI metric is used in the real estate sector to measure a property’s potential profitability.The net operating income (NOI) and earnings before interest, taxes, depreciation, and amortization ( EBITDA) are each non-GAAP financial measures, yet widely used in their respective industries. Prologis REIT Real Estate Segment (RES) – NOI Example (Source: PLD 10-K) NOI vs. Most real estate companies – such as real estate investment trusts (REITs) and real estate private equity (REPE) firms – own multiple properties in their portfolios, so accurately analyzing NOI requires isolating the property-level profitability. In particular, the NOI metric is intended to capture profitability before any depreciation, interest, income taxes, corporate-level SG&A expenses, capital expenditures (Capex), or financing costs. However, more important than what expenses factor into NOI are the expenses that do NOT impact NOI. The NOI formula strives to isolate the core operating profits of real estate assets to avoid muddying the waters with non-operating items such as corporate overhead and non-cash items such as depreciation. Net Operating Income (NOI) = (Rental Income + Ancillary Income) – Direct Operating Expenses The net operating income (NOI) formula is the sum of the property’s rental income and ancillary income, subtracted by its direct operating expenses. closer to “apples-to-apples” comparisons) since the metric neglects financing costs, debt service, and capital expenditures (Capex). NOI is not only a practical measure to analyze the profitability of a given property, but the metric is also well-suited for comparability among different property investment opportunities (i.e.

#Noi cap rate pro

In practice, the net operating income (NOI) is a fundamental real estate metric because it is the standardized measure of profitability to analyze potential and existing property investments.īy determining the historical profitability of a property investment – which offers insights into the profit potential of the property on a pro forma basis – the net operating income (NOI) facilitates better-informed investing decisions. The NOI metric, stated in simple terms, reflects the income generated by a property upon subtracting the direct operating expenses.

#Noi cap rate how to

How to Calculate Net Operating Income (NOI)?

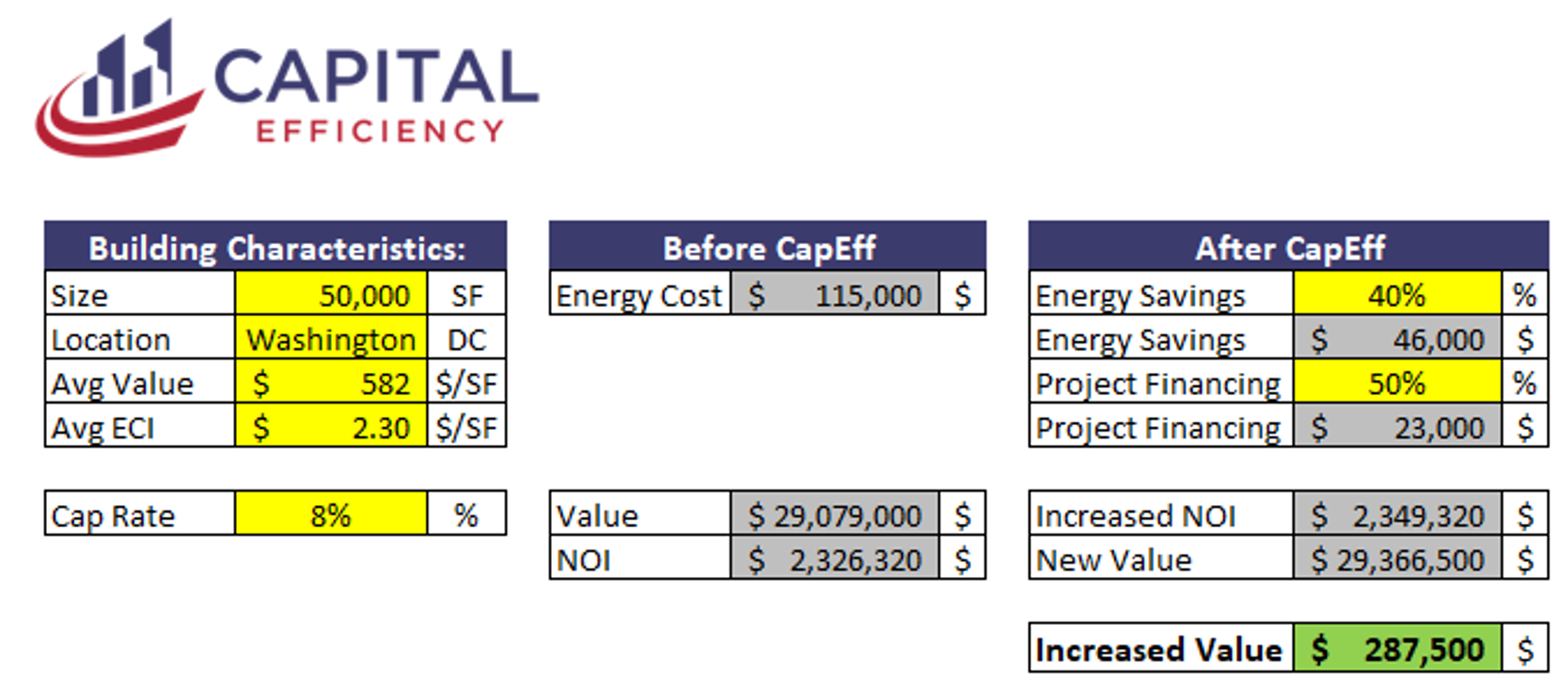

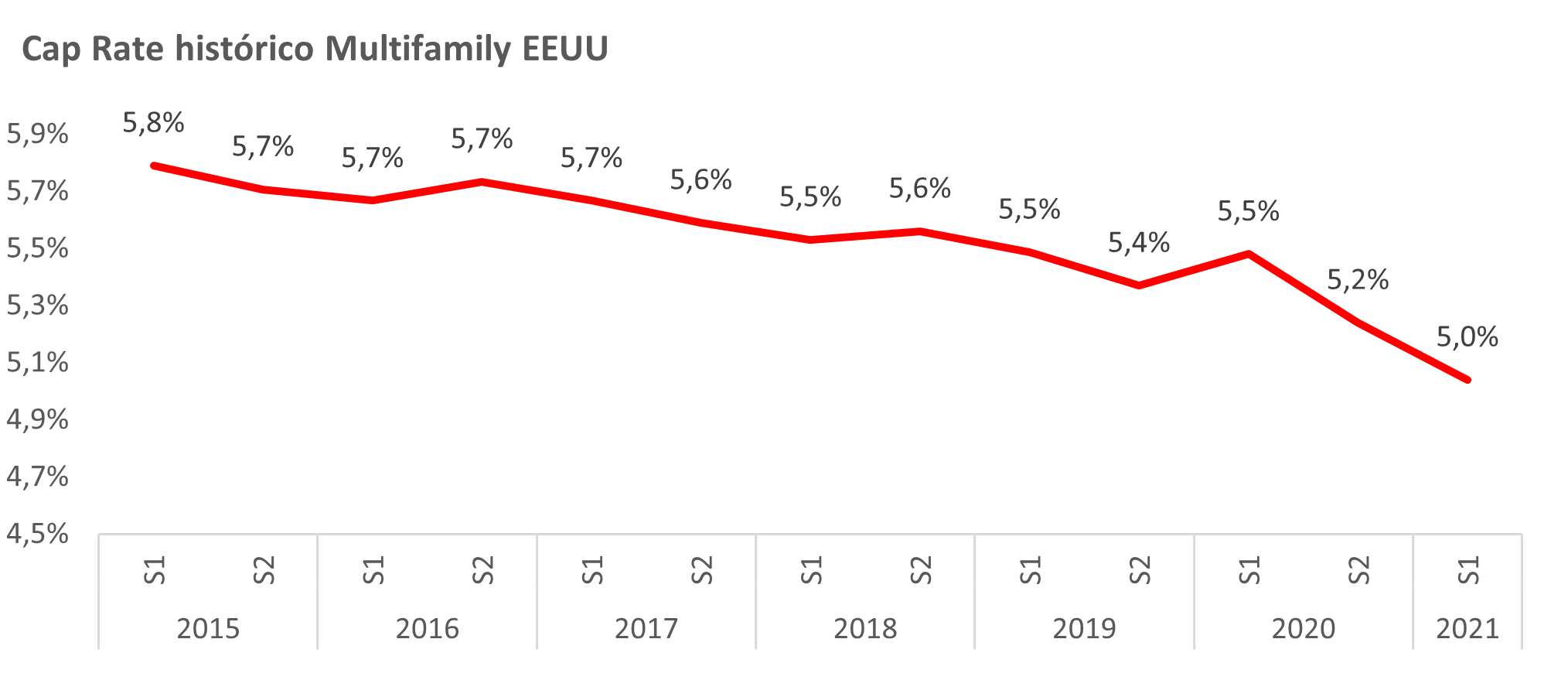

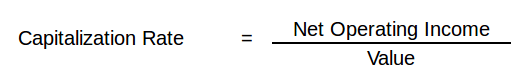

The net operating income (NOI) is part of the capitalization rate calculation, wherein NOI is divided by the market value of the property to arrive at the implied cap rate.NOI is intended to determine the profitability of a given property before accounting for the depreciation expense, financing costs (interest), income taxes, corporate-level SG&A expenses, tenant improvements, and capital expenditures (Capex).

The net operating income (NOI) formula starts by calculating the sum of a property’s rental and ancillary income, which is then subtracted by any direct operating expenses incurred.NOI stands for “Net Operating Income” and measures the profitability of an income-generating property prior to deducting financing costs and taxes.

0 kommentar(er)

0 kommentar(er)